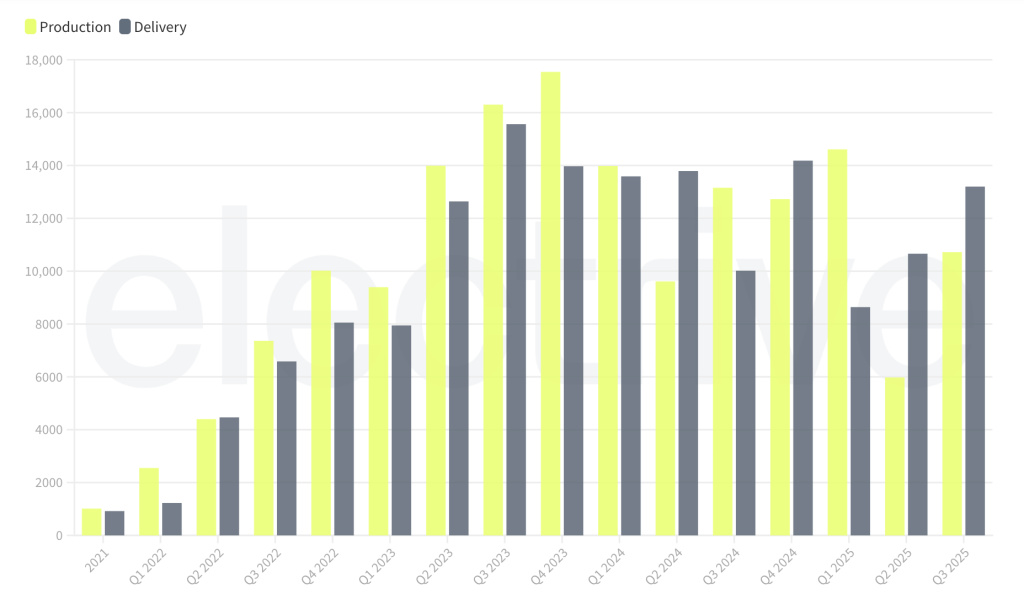

In its third quarter results, Rivian delivered roughly 13,000 vehicles to customers — in fact, 13,201 units — marking one of its strongest quarters in 2025.

Here’s a breakdown of what that delivery number means, the context around it, and what lies ahead:

What Went Down in Q3

- Deliveries: 13,201 vehicles were delivered in Q3.

- Production: During the same period, Rivian produced 10,720 vehicles at its Normal, Illinois, facility.

- Year-over-Year Growth: These deliveries represent a ~32 % increase over the same quarter in the previous year, reflecting rising momentum for Rivian’s EV products.

In short, the company delivered more cars than it produced in the quarter, a pattern sometimes seen as automakers draw down finished inventory or pull forward deliveries. Moreover, the delivery number slightly exceeded many analysts’ expectations — the consensus being around 12,690 units.

Interpretation & Implications

Delivering ~13,000 vehicles is a strong showing for Rivian, especially considering the macro headwinds in the EV and auto sectors. But the performance is a double-edged sword:

Positives

- Demand & Execution

Surpassing expectations suggests Rivian still has appetite in the market and is managing order fulfillment effectively. - Momentum for Future Models

Investors and analysts see this performance as a stepping stone toward the upcoming R2 model, which is expected to be lower-cost and higher-volume — a crucial product for Rivian’s growth.

Challenges & Risks

- Production Limitations

With production at 10,720 units versus deliveries of 13,201, Rivian is operating with tight margins between manufacturing and delivery. Any supply chain hiccup or production delay could strain its ability to meet demand. - Revised Guidance

Despite the strong quarter, Rivian trimmed the midpoint of its full-year delivery guidance to 41,500–43,500 vehicles, down slightly from earlier ranges. This narrowed outlook signals caution about the rest of the year, especially for the fourth quarter, which may see softer demand with the expiration of certain EV incentives. - Policy & Incentives Pressure

A big looming overhang is the expiration of the $7,500 federal tax credit for electric vehicle leasing on October 1, 2025. That incentive had long boosted purchase/leasing demand. Rivian and other EV makers now must contend with potentially slowed demand in Q4 and beyond. - Stock Market Reaction & Investor Sentiment

Despite beating Q3 delivery expectations, Rivian’s share price dropped by more than 7 % following the announcement — a sign that investors are more focused on forward guidance, cash burn, and risk than on one quarter’s success.

Outlook & What to Watch

- Fourth Quarter Demand

With incentives gone, Rivian may see weaker demand in Q4, putting pressure on sales and margins. - R2 Launch Execution

The company’s ability to bring R2 — its more affordable SUV model — to market successfully will likely be pivotal to its long-term trajectory. - Supply Chain & Cost Management

Rising tariffs on auto parts and shifting trade policies make managing costs and sourcing critical. - Balance Sheet & Burn Rate

Continued profitability is still a stretch. Investors will closely scrutinize cash flow, capital expenditure, and efforts to reduce negative margins. - Quarterly Earnings Report

Rivian is expected to publish its full Q3 financials after market close on November 4. That report will add color — revenue, margins, order backlog, and guidance — which could shift sentiment further.

Summary

In summary: delivering ~13,000 vehicles in Q3 was a solid demonstration of demand strength and execution for Rivian. Yet the trimmed guidance, shifting policy environment, and capital intensity of the EV business temper enthusiasm.

The success or failure of its next-gen models (notably R2), along with cost control and operational discipline, will be critical for sustaining momentum.